Full Capital Expensing Programme

After the success of the Super Tax Deduction Scheme, the Government have provided the machining industry with the 'Full Capital Expensing Programme'.

Chancellor Jeremy Hunt delivered the UK Spring Budget 2023 yesterday; with the UK economy aiming to get "back on track", the government is "remaining vigilant" and taking the necessary steps towards economic stability through increasing funding to specific industries and regions.

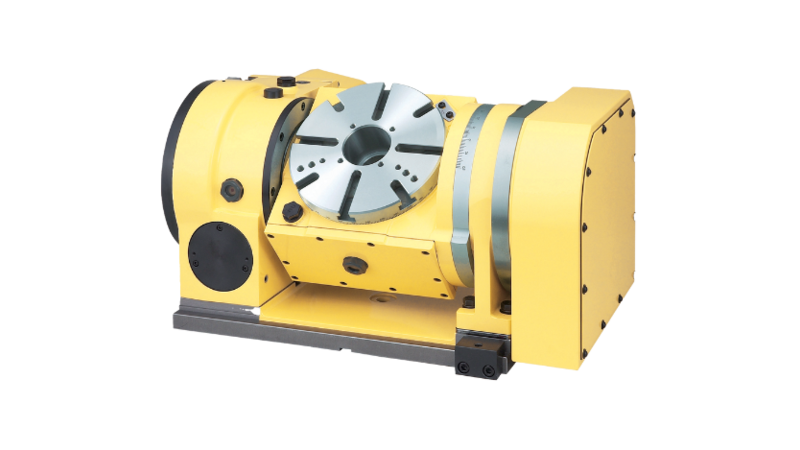

From April 2023 until the end of March 2026, companies can claim 100% capital allowances on qualifying plant and machinery investments. This includes any and all NIKKEN solutions, from our world-renowned Multi-Lock to our 5AX-201. Full expensing allows companies to write off the cost of investment in one go, and under full expensing, for every pound a company invests, their taxes are cut by up to 25p! This will ensure that the UK’s capital allowances regime is world-leading.

What better time to invest in NIKKEN and save yourself money by doing so?!

Our range of high precision and durable solutions are favoured amongst high-stature manufacturing

environments covering aerospace, medical, oil and gas, motorsport, power engineering, and the mould and die sectors.

NIKKEN’s extensive product range, combined with technical expertise, training and after-sales service,

come together to deliver a superior end-to-end experience that allows our customers the opportunity to

successfully compete in the global marketplace.

As a result of measures announced in the Spring budget and Full Capital Expensing Scheme, businesses will now benefit from:

- Full expensing – which offers 100% first-year relief to companies on qualifying new main rate plant and machinery investments from 1 April 2023 until 31 March 2026

- The 50% first-year allowance (FYA) for expenditure by companies on new special rate (including long life) assets until 31 March 2026

- The Annual Investment Allowance (AIA) provides 100% first-year relief for plant and machinery investments up to £1 million, which is available for all businesses, including unincorporated businesses and most partnerships.

Investment is a key driver of productivity growth, and the 'Full expensing scheme' builds on the success of the super-deduction, allowing companies to write off 100% of the cost of investment in one go. Furthermore, in the capital allowances survey last year, businesses showed a clear preference for full expensing over the other options under consideration on the basis of its simplicity and generosity.

Utilise our NEW NIKKEN Tooling Calculator to see how much you can save by using a world-renowned NIKKEN tool holder and by taking advantage of the Government's Full Capital Expensing Programme!

Contact your local business manager or call us at 01709 366306 to learn more.